To transfer money from Cash App to a bank account, open Cash App, tap the “Balance” tab, and select “Cash Out.” Enter the amount, choose the deposit speed, and confirm.

Cash App makes sending money to your bank account simple and efficient. This mobile payment service allows users to transfer funds quickly and safely. Users can enjoy a seamless experience with just a few taps. Whether you need to move money for daily expenses or save it for future use, Cash App provides a reliable solution.

It’s important to link your bank account accurately to avoid issues. This service is particularly useful for individuals who value convenience and speed in their financial transactions. With Cash App, managing your money becomes more straightforward and hassle-free.

Step-by-step Guide

Transferring money from Cash App to your bank account is easy. This guide will help you step-by-step. Cash App is a popular mobile payment service. It allows you to send and receive money quickly. Follow these steps to move your funds to your bank.

Link Your Bank Account To Cash App

First, you need to link your bank account to Cash App. Open the Cash App on your phone. Tap the “Banking” tab. It looks like a house icon at the bottom of the screen. Next, tap “Add a Bank” or “Linked Accounts”.

Follow these steps:

- Enter your bank account number.

- Enter your routing number.

- Confirm your bank details.

Make sure to double-check your information. This will ensure that your account is linked correctly. Now your bank is connected to Cash App.

Verify Your Bank Account

After linking your bank account, you need to verify it. Verification ensures the security of your transactions. Cash App will send two small deposits to your bank account. These deposits will be less than one dollar each. Check your bank account for these deposits.

Follow these steps to verify:

- Open the Cash App and go to the “Banking” tab.

- Tap on your linked bank account.

- Enter the amounts of the two deposits.

If the amounts are correct, your bank account will be verified. Now you can transfer money with confidence.

Transfer Money From Cash App To Bank Account

Now that your bank account is linked and verified, you can transfer money. Open Cash App and go to the “Banking” tab. Tap the “Cash Out” button. Enter the amount you want to transfer. Choose either “Standard” or “Instant” transfer.

If you choose “Standard”, the transfer is free but takes 1-3 business days. If you choose “Instant”, the transfer happens immediately but has a small fee. Confirm your transfer details. Tap “Cash Out” again to complete the transfer.

Check your bank account to ensure the money is transferred. Now you know how to transfer money from Cash App to your bank account.

Fees And Timeframe

Transferring money from Cash App to a bank account is simple and quick. It’s important to understand the fees and the timeframe involved. These aspects can help you plan better and avoid any surprises. Let’s dive into the details about fees and the time it takes to transfer money.

Understanding The Fees Involved

Cash App charges a fee for instant transfers. The standard transfer option is free. Here is a breakdown of the fees:

- Standard Transfer: Free, takes 1-3 business days.

- Instant Transfer: The fee is 1.5% of the transfer amount.

For example, if you transfer $100 via instant transfer, the fee will be $1.50. This fee is deducted from the amount you are sending. It’s important to choose the best option based on your needs. If you don’t need the money right away, the standard transfer is the best choice.

How Long Does It Take To Transfer Money?

Standard transfers usually take 1-3 business days. This is because banks process these transfers during business hours. On weekends and holidays, transfers may take longer.

Instant transfers are much quicker. They usually take a few seconds to a few minutes. Here is a comparison:

Choose the transfer type based on how quickly you need the money. If you need it urgently, opt for the instant transfer. If you can wait, the standard transfer is a better option.

Tips For A Smooth Transfer

Transferring money from Cash App to a bank account can be easy. Follow these tips for a smooth transfer. It ensures your funds move quickly and safely. Cash App offers a user-friendly way to manage your money. Knowing the right steps can make the process hassle-free.

Ensure Sufficient Funds In Your Cash App Account

Always check your Cash App balance before transferring money. It’s important to have enough funds to cover the transfer. This prevents any delays or errors.

Here are some steps to check your balance:

- Open the Cash App on your phone.

- Look at the home screen. Your balance is shown there.

- If you need more funds, add money to your Cash App account.

Adding funds is simple. You can link a bank account or debit card to Cash App. Then, transfer money from your bank to Cash App.

Steps to add funds:

- Tap the “Banking” tab on the Cash App home screen.

- Press “Add Cash.”

- Enter the amount you want to add.

- Confirm the transfer.

Checking and adding funds helps ensure a smooth transfer to your bank account.

Double-check Your Bank Account Details

Make sure your bank account details are correct. This step is crucial to avoid any mistakes.

Here are some key details to check:

- Bank name

- Account number

- Routing number

- Account holder’s name

Confirm these details before starting the transfer. A small error can cause delays or loss of funds.

Steps to verify your bank details on Cash App:

- Open the Cash App.

- Tap the “Banking” tab.

- Select “Linked Accounts.”

- Review your bank account information.

- Edit if necessary.

Accurate bank details ensure a smooth and quick transfer.

Contact Customer Support If You Encounter Any Issues

If you face any problems, reach out to Cash App customer support. They can help resolve issues quickly.

Ways to contact support:

- Open the Cash App.

- Tap the profile icon on the home screen.

- Select “Support.”

- Choose the issue you need help with.

Common issues they can assist with:

- Failed transfers

- Incorrect bank details

- App errors

Prompt support ensures your money transfer goes smoothly. Don’t hesitate to ask for help.

Alternatives To Cash App

Transferring money from Cash App to a bank account is easy. Open the app, tap on the balance, and choose “Cash Out.” Enter the amount and select the transfer speed. Confirm your choice and the money will move to your bank. Yet, Cash App is not the only option. There are other ways to move money. Let’s explore them.

Exploring Other Money Transfer Apps

There are many apps to transfer money. Some are fast and easy to use. Venmo is one of them. It is popular and has many users. You can send money to friends and family. The app also has a social feed. This makes it fun to see what others are paying for. PayPal is another option. It is known around the world. You can link it to your bank account and move money fast. Zelle is great too. It works with many banks. Transfers are quick and free. Google Pay and Apple Pay also let you send money. They are secure and easy to use. Here is a table to compare some features:

Using Traditional Banking Methods

Traditional banking methods can also move money. Wire transfers are one way. They are fast but can cost money. ACH transfers are another option. They are slower but often free. You can also write a check. This is the slowest but very secure. Bank transfers can be done online. Log in to your bank’s website. Choose “Transfer Money” and follow the steps. Moving money can take a few days. You can also visit a bank branch. Fill out a form and give it to a teller. They will help you move the money. These methods are safe and trusted. Here are some pros and cons:

- Wire Transfers: Fast but can be expensive.

- ACH Transfers: Slower but often free.

- Checks: Secure but slow.

- Online Transfers: Easy but can take time.

- Bank Branch: Personal help but can be inconvenient.

Security And Privacy

Transferring money from Cash App to your bank account is easy and safe. Cash App provides high security and privacy for your transactions. Understanding how Cash App protects your financial information is important. It’s also vital to know how you can keep your transactions secure.

How Cash App Protects Your Financial Information

Cash App uses advanced security measures to protect your financial information. This includes data encryption and fraud detection technologies. Here are some ways Cash App keeps your money safe:

- Encryption: Cash App encrypts all data sent from your app. This ensures your information stays private.

- Secure servers: All transactions go through secure servers. This adds an extra layer of protection.

- Two-factor authentication: Cash App offers two-factor authentication. This means you need to verify your identity twice.

- Monitoring: Cash App continuously monitors transactions. This helps to spot and stop any suspicious activity.

Cash App also has a dedicated support team. They are available to help with any security issues. If you ever have a problem, you can contact them for assistance.

Tips For Keeping Your Transactions Secure

Keeping your transactions secure is very important. Here are some tips to help you:

- Use a strong password: A strong password is hard to guess. It should include numbers, letters, and symbols.

- Enable two-factor authentication: This adds an extra layer of security. It makes it harder for others to access your account.

- Monitor your account regularly: Check your transactions often. This helps you spot any unusual activity quickly.

- Avoid public Wi-Fi: Public Wi-Fi can be risky. Use a secure network when transferring money.

Never share your login details with anyone. If someone else has your login details, they can access your money. Always log out of your account after using it on a shared device.

Following these tips helps keep your transactions safe. Always stay alert and protect your financial information.

Common Issues And Troubleshooting

Transferring money from Cash App to a bank account is simple. Yet, sometimes issues can occur. This guide will help you understand common problems and how to solve them. Learn how to handle transfer failures, missing money, and how to contact support. We also cover the option to buy verified CashApp accounts.

Transfer Failed: What To Do?

A failed transfer can be frustrating. Always check your internet connection first. Poor connections can cause issues. Ensure your Cash App is up-to-date. Outdated versions may have bugs. If the transfer fails, try these steps:

- Restart the app. Sometimes, a simple restart can fix issues.

- Check your bank account details. Make sure all information is correct.

- Verify your Cash App balance. Ensure you have enough funds for the transfer.

If these steps don’t work, consider contacting Cash App support. They can help identify and solve the problem. Always keep your app updated for the best performance.

Money Not Showing Up In Bank Account: Possible Reasons

Sometimes, money might not show up in your bank account right away. Bank processing times can vary. It may take a few hours or even a day. Double-check your bank details. Incorrect information can delay the transfer. Look out for these possible reasons:

- Wrong bank account number. Ensure all details are correct.

- Bank holidays or weekends. Transfers may take longer during these times.

- App glitches. Sometimes, the Cash App may have temporary issues.

Contact your bank if the money doesn’t show up. They can provide more information. Check your transaction history in Cash App to ensure the transfer was completed. Keeping track of these details can help resolve issues quickly.

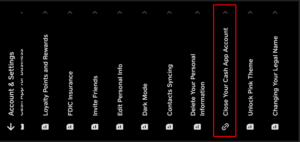

Contacting Cash App Support

Sometimes, you need more help. Cash App support is there for you. Follow these steps to contact support:

- Open Cash App. Navigate to the profile icon.

- Tap on ‘Support’. This will open the help menu.

- Select your issue. Choose the topic that best describes your problem.

Send a detailed message explaining the issue. Include any error messages you received. Be patient. Support may take some time to respond. Always provide accurate information to help them solve your problem faster.

Buy Verified Cashapp Accounts

Some people prefer to buy verified CashApp accounts. Verified accounts come with added features. They can send and receive larger amounts. Consider these benefits when buy verified cash app accounts:

- Higher transaction limits. More money can be transferred at once.

- Enhanced security. Verified accounts are more secure.

- Better support. Verified users may get priority help.

Ensure you buy from a trusted source. Scams are common, so always be careful. Research the seller and read reviews. Buy Cash App verified accounts can make your Cash App experience smoother and more efficient.

Frequently Asked Questions

How Do I Link My Bank Account To Cash App?

To link, open Cash App, tap ‘Banking’, then ‘Add a Bank’, and follow the prompts.

What Is The Transfer Fee On Cash App?

Cash App charges 1. 5% for instant transfers. Standard transfers are free.

How Long Do Standard Transfers Take?

Standard transfers to a bank account typically take 1-3 business days.

Can I Transfer Money Without Linking A Bank?

Linking a bank account is necessary to transfer money from Cash App.

Is There A Transfer Limit On Cash App?

Yes, Cash App limits transfers to $7,500 weekly for verified accounts.

How Do I Verify My Cash App Account?

Provide your full name, date of birth, and the last four digits of your SSN.

Can I Cancel A Transfer On Cash App?

Once initiated, transfers to your bank cannot be canceled.

What If My Transfer Fails?

Check your bank details, and internet connection, or contact Cash App support.

Does Cash App Support International Transfers?

No, Cash App only supports transfers within the United States.

How Do I View My Transfer History?

Tap the ‘Activity’ tab in the Cash App to view all transactions.

In short.

Transferring money from Cash App to your bank account is straightforward. Follow the steps outlined to ensure a smooth transaction. Keep your app updated for the best experience. With these tips, managing your finances becomes easier. Enjoy seamless and hassle-free transfers every time.