How to borrow money from CashApp, open Cash App and navigate to the “Banking” tab. Select “Borrow” and follow the prompts.

Open the Cash App and look for the “Borrow” option under the “Banking” section. If you don’t see the “Borrow” option, you are not eligible for this feature.

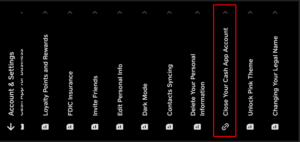

Tap on “Borrow” and then “Unlock” to activate the Cash App Borrow feature.

Cash App will show you the maximum amount you can borrow, typically between $20 and $200. Select the amount you need and the repayment plan, which is usually 4 weekly installments.

Review the loan terms carefully, including the flat 5 fee, and accept the loan limit if the agreement makes sense for your financial situation.

Once approved, the borrowed funds will be deposited directly into your Cash App balance. Make sure you have enough funds to repay the loan on time, as late payments can negatively impact your credit.

The key factors that determine your eligibility for Cash App Borrow are your location, Cash App usage history, and creditworthiness, though Cash App does not disclose the exact criteria

Cash App offers a convenient way to manage your finances, including borrowing money tab when needed. With its user-friendly interface, you can quickly access cash app’s borrowing feature directly from your mobile device. The process is straightforward and designed for ease of use, making it an attractive option for those seeking short-term loans.

By accessing the “Banking” tab and selecting “Borrow,” users can follow simple on-screen instructions to complete their loan request. This feature aims to provide quick financial relief, ensuring users can address their immediate monetary needs without hassle. Cash App’s borrowing service is a testament to its commitment to providing versatile financial solutions for its users.

What app will let me borrow $200?

Cash App offers a Borrow feature that lets you borrow between $20 and $200, but it’s only available to certain users who make regular deposits of at least $1,000 per month. To check if you qualify, look for the Borrow option in your Cash App.

MoneyLion’s Instacash provides interest-free cash advances up to $250 that are deposited into your account within minutes. There are no mandatory fees, but you can pay an optional tip.

Earnin is an app that allows you to borrow against your next paycheck quickly without any fees or interest. You can borrow up to $100 per day and $500 per pay period.

Dave is another app that offers cash advance apps up to $200 with no interest or credit check[3]. You pay a $1 monthly subscription fee to access the advance feature.

The key things to consider are the fees, speed of funding, and eligibility requirements. Apps like Cash App and Brigit require you to meet certain criteria to qualify for advances. Payday loans are another option, but they often have very high interest rates that can lead to a cycle of debt.

Introduction to Cash App Borrowing

In today’s fast-paced digital world, financial flexibility is paramount. One of the tools that have risen to prominence in recent years is Cash App, a versatile mobile payment service. Among its many features, the ability to borrow money stands out as a particularly valuable option for users. So, how to borrow money from Cashapp? This comprehensive guide will walk you through the process, ensuring you understand every aspect of borrowing money using this platform.

Cash App, developed by Square Inc., has transformed how we handle money. Initially known for its peer-to-peer payment capabilities, Cash App has expanded its services to include features like direct deposits, Bitcoin trading, and now, personal loans. Borrowing money from Cash App is a straightforward process, but it requires a clear understanding of the platform’s functionality and requirements. Whether you need quick cash for an emergency or want to manage your finance charge better, knowing how to borrow money from Cashapp can be a lifesaver.

To borrow money from Cash App, you must first be eligible for this service. Not all users will have the borrowing option available, as it depends on several factors, including your usage history and account status. This guide will delve into these aspects, helping you determine your eligibility and navigate the borrowing process with ease.

Eligibility Criteria

Before you can borrow money from Cash App, it’s essential to understand the eligibility criteria. Cash App evaluates several factors to determine if you qualify for a loan feature. These factors ensure that the borrowing service is used responsibly and that the borrowers can repay their loans on time.

First, your account must be in good standing. This means you should have a verified account with accurate personal information. Verification typically involves linking a bank account or debit card and providing identification documents. Additionally, your transaction history plays a crucial role. Regular use of Cash App for payments and other transactions increases your chances of being eligible for a loan.

Another critical factor in how to borrow money from Cashapp is your credit history. While Cash App does not perform a hard credit check, it considers your financial behavior within the app. This includes timely repayment of any previous loans and maintaining a positive balance. If you’ve had issues with overdrafts or insufficient funds, it might affect your eligibility.

Moreover, Cash App may use algorithms to assess your risk profile. This includes analyzing your spending habits, the frequency of your transactions, and your overall financial health. Understanding these criteria can help you take proactive steps to improve your eligibility for borrowing money from Cash App.

Setting Up Your Cash App Account

The first step in how to borrow money from Cashapp is setting up your account correctly. A well-set-up account not only ensures smooth transactions but also enhances your chances of accessing the borrowing feature. Here’s a step-by-step guide to help you get started.

Download the Cash App from the App Store or Google Play Store and install it on your smartphone. Once installed, open the app and enter your phone number or email address to create an account. You’ll receive a code to verify your identity. After verification, link your bank account or debit card to Cash App. This step is crucial as it enables you to send and receive money seamlessly and is vital in the process of how to borrow money from Cashapp.

Next, you need to verify your identity. This process involves entering your full name, date of birth, and the last four digits of your Social Security Number (SSN). Providing accurate information is vital as it helps Cash App verify your identity and increases your chances of accessing additional features, including borrowing money.

Once your account is set up and verified, familiarize yourself with the app’s interface. Explore the various tabs and features, such as the ‘Banking’ tab, where you can manage your linked accounts and view your balance. Understanding the layout will make it easier to navigate when you need to borrow money from Cash App.

Navigating the Cash App Interface

To effectively understand how to borrow money from Cashapp, you must navigate its user-friendly interface with ease. Cash App is designed to be intuitive, but understanding where to find specific features can save you time and frustration.

Upon opening Cash App, you’ll land on the home screen, which displays your current balance. The bottom navigation bar is key to accessing different features. The most critical tabs are the ‘Banking’ tab, where you view and manage your funds, and the ‘Cash Card’ tab, which allows you to order a debit card linked to your Cash App balance.

To access the borrowing feature, you need to click on the ‘Banking’ tab. Here, you’ll find the ‘Borrow’ option if it’s available to you. Cash App will guide you through the borrowing process step-by-step. The interface ensures that even first-time users can follow along without difficulty.

Besides borrowing, the ‘Activity’ tab is essential for tracking your transactions, including loan repayments. Keeping an eye on your activity helps manage your finances effectively and ensures you’re aware of all deductions and deposits.

Understanding the layout and functionality of Cash App’s interface is crucial for a seamless borrowing experience. Whether you’re checking your balance, repaying a loan, or accessing customer support, knowing where to find each feature enhances your overall user experience and aids in how to borrow money from Cashapp.

Understanding Cash App Borrowing Limits

One of the critical aspects to understand when you borrow money from Cash App is the borrowing limits. Cash App determines these limits based on several factors, ensuring that the loans provided are manageable for users. How to borrow money from Cashapp effectively involves understanding these borrowing limits.

Cash App borrowing limits can vary significantly from one user to another. Typically, these limits range from $20 to $200, depending on your account history and usage. Regular users with a history of responsible financial behavior may qualify for higher limits. Conversely, new or infrequent users might find their borrowing limits lower.

The limits are determined through an algorithm that considers various factors, including your transaction history, the amount of money you receive and send, and your overall financial activity within the app. Regular transactions and a healthy balance can positively influence your borrowing limit.

To potentially increase your borrowing limit and better understand how to borrow money from Cashapp, maintain an active and responsible Cash App account. Ensure timely repayments of any existing loans and avoid negative balances. Regularly using Cash App for various transactions can also demonstrate financial reliability, potentially leading to higher borrowing limits.

Understanding these limits helps you plan your borrowing needs better. Whether you need a small amount for an emergency or a larger sum for significant expenses, knowing your borrowing capacity ensures you make informed financial decisions about how to borrow money from Cashapp.

Buy Cash App Verified Accounts

To safely Buy verified Cash App accounts, the top platform to consider is cashappsell.com. These reputable online marketplaces offer verified Cash App accounts with features like higher transaction limits, increased security, and access to Bitcoin trading.

When buy verified Cash App account Reddit, it’s important to evaluate the seller’s reputation, pricing, and customer reviews to ensure a smooth and satisfactory transaction. Reputable sellers can provide genuine accounts that are yours to keep. Delivery is typically fast, and the stock is consistently available.

The Application Process

The process of how to borrow money from Cashapp is straightforward but requires attention to detail to ensure a successful application. Here’s a step-by-step guide to help you navigate the process seamlessly.

First, open your Cash App and navigate to the ‘Banking’ tab. Here, you’ll see the ‘Borrow’ option if you’re eligible. Click on this option to start the application process. Cash App will prompt you to enter the amount you wish to borrow. Based on your eligibility, you’ll be shown the available amounts.

Next, review the loan terms carefully. This includes the repayment schedule, interest rates, and any additional fees. Understanding these terms is crucial to ensure you can repay the loan without any issues. Once you agree to the terms, proceed by clicking the ‘Accept’ button.

Cash App may require additional information to process your loan. This can include verifying your identity or providing additional financial information. Ensure all information is accurate and up-to-date to avoid delays in how to borrow money from Cashapp.

After submitting your application, Cash App will review your request. If approved, the borrowed amount will be credited to your Cash App balance almost instantly. You can then use the funds for your immediate needs. Remember to keep track of your repayment schedule to avoid any penalties and ensure a smooth experience with how to borrow money from Cashapp.

Interest Rates and Fees

When you borrow money from Cash App, understanding the associated interest rates and fees is essential for managing your loan effectively. These financial aspects can significantly impact the total cost of your loan and are critical in the process of how to borrow money from Cashapp.

Cash App typically charges a flat interest rate on the amount borrowed. This rate can vary based on several factors, including your creditworthiness and borrowing history. It’s crucial to review the interest rate offered before accepting the loan to ensure it’s within a manageable range.

In addition to the interest rate, there may be other fees associated with borrowing from Cash App. These can include processing fees, late payment fees, and early repayment penalties. While some fees are standard, others may vary depending on your loan terms and repayment behavior.

To get a clear picture of the total cost of how to borrow money from Cashapp, it’s advisable to calculate the Annual Percentage Rate (APR), which includes both the interest rate and any additional fees. This gives you a better understanding of how much the loan will cost over its entire term.

By being aware of the interest rates and fees, you can make informed decisions about borrowing and ensure you can repay the loan without financial strain. Always read the fine print and ask questions if any terms are unclear, ensuring a comprehensive understanding of how to borrow money from Cashapp.

Repayment Terms

Understanding the repayment terms is crucial when you borrow money from Cash App. These terms outline how and when you need to repay the borrowed amount, ensuring you manage your finances effectively and avoid any penalties.

Cash App typically offers flexible repayment schedules, allowing users to repay their loans in installments. The repayment period can vary but usually ranges from a few weeks to several months, depending on the loan amount and terms agreed upon during the application process.

The repayment schedule will detail the due dates for each installment and the amount payable. It’s important to adhere to these dates to avoid late payment fees. Cash App may offer automatic deductions from your linked bank account or Cash App balance to ensure timely manual payments.

If you find yourself in a position to repay the loan earlier than scheduled, Cash App may allow for early repayment without penalties. However, it’s essential to check the specific terms of your loan, as some user agreement might include early repayment fees.

By understanding and adhering to the repayment terms, you can manage your borrowed funds effectively, ensuring a positive borrowing experience and maintaining a good standing with Cash App for any future borrowing needs. Knowing how to borrow money from Cashapp and repaying it responsibly is key to leveraging this feature for your financial services platform benefit.

Security and Privacy

When you borrow money from Cash App, security and privacy are paramount. Cash App employs robust security measures to protect your financial information and ensure your borrowing experience is safe. Understanding these security features is essential for anyone looking into how to borrow money from Cashapp.

Cash App uses encryption to secure all transactions, ensuring that your data is protected from unauthorized access. This means that when you borrow money, your personal and financial information is encrypted and kept confidential. Additionally, Cash App employs fraud detection systems that monitor for suspicious activity, adding an extra layer of security.

Privacy is another critical aspect. Cash App is committed to protecting user data and follows strict privacy policies. When you borrow money from Cash App, your information is not shared with third parties without your consent. This ensures that your borrowing activities remain private and secure.

For those concerned about how to borrow money from Cashapp safely, it’s reassuring to know that Cash App also offers features such as two-factor authentication (2FA). This adds an extra step to verify your identity, making it harder for unauthorized users to access your account.

By understanding and utilizing these security features, you can confidently navigate the process of borrowing money from Cash App, knowing your information is well-protected.

Managing Your Loan

Effectively managing your loan is crucial once you learn how to borrow money from Cashapp. Proper management ensures that you can repay the loan on time and maintain a positive relationship with Cash App for future borrowing needs.

First, keep track of your repayment schedule. Cash App provides detailed information about your loan, including the due dates and amounts for each installment. Regularly check the ‘Activity’ tab in the app to stay updated on your repayment status. Setting reminders for due dates can help you avoid late payments and associated fees.

Next, consider automating your repayments. Cash App allows you to set up automatic deductions from your linked bank account or Cash App balance. This feature ensures that payments are made on time, reducing the risk of missing a due date. Automation is a helpful tool for anyone figuring out how to borrow money from Cashapp and manage it efficiently.

Additionally, if you have extra funds, think about making early repayments. While some loans may have early repayment fees, paying off your loan ahead of schedule can save on interest costs. Check your loan terms to see if early repayment is a viable option.

Lastly, if you encounter financial difficulties, contact Cash App’s customer support. They can provide assistance and possibly offer solutions such as adjusting your repayment schedule. Effective communication can help you manage your loan better and maintain a good standing.

By following these tips, you can manage your loan effectively, ensuring a smooth borrowing experience with Cash App.

Buy Verified Cash App Accounts

Best website to buy verified cash app accounts – 100% Full verified – BTC Enable Or NON BTC Enable – All limit Tag – At a cheap price !

You will now find the best quality accounts at the cheapest prices. We have all types of accounts like – BTC Enable, non BTC enable, Verified, Support, Re-verified service, Payment received service, 1k, 4k, 15k, 25k BTC and non BTC enable cash app Accounts available any time.

✅LD Backup File & Phone Login Cash App Service✅

✅Gaming Payment Received & Cash App Accounts Available✅

✅4k Limit (Normal/BTC Enable)

✅15k Limit (Normal Only)

✅25k Limit (Normal/BTC Enable)

✅✅Direct Deposit On, Physical Card Active✅✅

Our accounts are 100% legit and verified.

- BTC & non BTC Enable Cash app

- Re-Verified Guaranteed

- Cash App Full Support

- Bitcoin Withdraw Possible

- Old & New Account Available

- Cash App to Cash App Send Money

- Cash OUT & Add Cash

- 4k, 15k, 25k Limit tag

- Direct Deposit On

- Virtual card active

- Card Lock & Unlock Available

- Number verified

- Email Verified

- SSN Verified

- Card Verified

- Bank Verified

- BTC Verified

- ID, License, Passport Verified

- 24×7 customer Support

Troubleshooting Common Issues

When learning how to borrow money from Cashapp, you might encounter some common issues. Knowing how to troubleshoot these problems can help you resolve them quickly and continue using the service without interruption.

One common issue is eligibility. Not all users have access to the borrowing feature. If you find that you cannot borrow money from Cash App, check that your account is verified and in good standing. Ensure your personal information is up to date and that you have a history of regular transactions.

Another issue could be related to the application process. If your loan application is denied, review the criteria and ensure you meet all requirements. This might include verifying your identity again or providing additional financial information. Understanding the specifics of how to borrow money from Cashapp can help you address these issues.

Technical glitches can also occur. If you experience app crashes or errors while trying to borrow money, ensure that you have the latest version of Cash App installed. Restarting your device or reinstalling the app can often resolve these technical issues. Additionally, clearing the app cache or contacting Cash App support can help fix persistent problems.

If you encounter repayment issues, such as missed payments or incorrect deductions, contact Cash App support immediately. They can help resolve any discrepancies and ensure your account remains in good standing. Understanding these common issues and their solutions can make the process of borrowing money from Cash App smoother and more efficient.

Comparing Cash App Loans to Traditional Loans

When considering how to borrow money from Cashapp, it’s essential to compare it with traditional loan options. Understanding the differences can help you decide which borrowing method suits your needs best.

Cash App loans are typically smaller and designed for short-term needs. The application process is straightforward and can be completed within the app, making it a convenient option for quick cash. Unlike traditional loans, which may require extensive paperwork and a longer approval process, Cash App offers a simpler and faster way to access funds.

Interest rates and fees for Cash App loans can be different from traditional loans. While Cash App might charge higher rates due to the short-term nature of the loans, traditional banks often offer lower rates but require collateral or a good credit score. Knowing how to borrow money from Cashapp means understanding these trade-offs.

Repayment terms also differ. Cash App offers flexible repayment schedules with automatic deductions, making it easier to manage payments. Traditional loans often have fixed monthly payments over a longer period, which can be more predictable but less flexible.

Another factor is credit impact. Cash App does not perform a hard credit check, making it accessible to users with lower credit scores. Traditional loans usually involve a thorough credit check, which can affect your credit score.

By comparing these aspects, you can make an informed decision about whether borrowing money from Cash App or opting for a traditional loan is the best choice for your financial situation.

Legal and Regulatory Considerations

Understanding the legal and regulatory considerations is crucial when exploring how to borrow money from Cashapp. Ensuring compliance with financial regulations protects you from legal issues and helps maintain a good standing with financial institutions.

Cash App operates under various financial regulations to provide a secure and legal borrowing service. These regulations vary by state and country, so it’s essential to be aware of the specific laws governing your region. Knowing how to borrow money from Cashapp within these legal frameworks ensures a smooth and compliant borrowing process.

One key regulatory aspect is the interest rate cap. Some regions have laws limiting the maximum interest rate that can be charged on loans. Cash App adheres to these regulations, ensuring that its interest rates are within legal limits. Understanding these limits can help you evaluate if the loan terms are fair and legal.

Another important consideration is consumer protection laws. These laws are designed to protect borrowers from predatory lending practices. Cash App complies with these regulations by providing clear and transparent loan terms, including interest rates, fees, and repayment schedules. Reading and understanding these terms is crucial when you borrow money from Cash App.

Privacy laws also play a significant role. Cash App is required to protect your personal and financial information under data protection regulations. This includes secure handling of your data and ensuring that your information is not shared without your consent.

By understanding these legal and regulatory considerations, you can confidently navigate the process of borrowing money from Cash App, knowing that you are protected by the law and that Cash App is compliant with all necessary regulations.

Customer Reviews and Testimonials

Customer reviews and testimonials provide valuable insights into how to borrow money from Cashapp effectively. They offer real-world experiences that can help you understand the benefits and potential pitfalls of using Cash App’s borrowing feature.

Many users appreciate the convenience and speed of borrowing money from Cash App. Positive reviews often highlight the straightforward application process and quick approval times. Users have shared how Cash App has helped them in emergencies, providing the funds they needed almost instantly. These testimonials underscore the app’s effectiveness in offering quick financial solutions.

However, there are also reviews that point out areas for improvement. Some users have mentioned issues with eligibility, noting that not everyone can access the borrowing feature. Others have highlighted concerns about interest rates and fees, suggesting that they can be higher compared to traditional loans. Understanding these reviews can help you make a more informed decision about how to borrow money from Cashapp.

Customer testimonials also provide tips on managing loans effectively. Many users recommend setting up automatic payments to avoid late fees and suggest keeping an eye on the repayment schedule to ensure timely payments. These practical tips can be incredibly useful when navigating the borrowing process.

By reading and considering customer reviews and testimonials, you gain a better understanding of the real-world experiences of others. This can guide you in making informed decisions and effectively managing your borrowing from Cash App.

Maximizing Borrowing Benefits

When you learn how to borrow money from Cashapp, it’s essential to maximize the benefits of this feature. Properly leveraging the borrowed funds can help you achieve your financial goals more efficiently.

First, use the borrowed money for strategic purposes. Whether it’s for emergency expenses, consolidating high-interest debt, or investing in a business opportunity, having a clear plan for the funds ensures they are used effectively. Planning how to borrow money from Cashapp with a specific goal in mind helps you make the most of the borrowed amount.

Next, take advantage of Cash App’s flexible repayment options. Setting up automatic payments can help you stay on track with your repayments, avoiding late fees and ensuring your loan is paid off on time. If possible, make early repayments to reduce the total interest paid over the life of the loan.

Additionally, maintaining a good borrowing history with Cash App can unlock higher borrowing limits in the future. By repaying your loans on time and keeping your account in good standing, you demonstrate financial responsibility, which can be beneficial if you need to borrow again.

It’s also wise to stay informed about any updates or changes to Cash App’s borrowing feature. Cash App frequently updates its services, and staying up-to-date can help you take advantage of new benefits or improved terms.

By strategically using the borrowed funds, managing repayments effectively, and maintaining a good borrowing history, you can maximize the benefits of borrowing money from Cash App.

Alternatives to Cash App Borrowing

When considering how to borrow money from Cashapp, it’s also helpful to explore alternative borrowing options. Comparing different methods can ensure you choose the best financial solution for your needs.

Traditional bank loans are one alternative. Banks offer personal loans with potentially lower interest rates and longer repayment terms compared to Cash App. However, they often require a higher credit score and more extensive documentation. Understanding how to borrow money from Cashapp and comparing it with traditional loans can help you decide which option suits your financial situation better.

Credit unions are another option. They typically offer lower interest rates and more personalized service. Membership is often required, but the benefits can be substantial. Exploring how to borrow money from Cashapp versus credit union loans can reveal which offers better terms and flexibility.

Online lenders provide another alternative. Companies like SoFi, LendingClub, and others offer quick, unsecured loans similar to Cash App. These platforms can be convenient but may have varying interest rates and fees. Knowing how to borrow money from Cashapp and comparing it with online lenders can help you find the best rates and terms.

Finally, consider peer-to-peer lending. Platforms like Prosper and Peerform connect borrowers directly with individual lenders, often providing competitive rates. By evaluating how to borrow money from Cashapp alongside peer-to-peer lending, you can identify the most advantageous borrowing option.

Exploring these alternatives ensures you make a well-informed decision, choosing the borrowing method that best meets your financial needs and goals.

Impact of Borrowing on Financial Health

Understanding how to borrow money from Cashapp and its impact on your financial health is crucial. Borrowing can provide immediate relief or funding, but it’s essential to manage it wisely to avoid long-term financial issues.

Borrowing responsibly involves assessing your ability to repay the loan on time. Late payments or defaults can negatively impact your financial health, leading to additional fees and a lower credit score. By knowing how to borrow money from Cashapp and making timely repayments, you can maintain a positive borrowing record.

It’s also important to consider the interest rates and fees. While Cash App offers convenient short-term loans, the costs can add up if not managed properly. Understanding these costs and incorporating them into your budget ensures you don’t overextend financially. Learning how to borrow money from Cashapp while managing these expenses is key to maintaining financial stability.

Borrowing can also affect your ability to save and invest. Allocating funds towards loan repayments may reduce the amount available for savings or investments. Balancing borrowing with your financial goals, such as building an emergency fund or investing in assets, is essential for long-term financial health.

Furthermore, borrowing should align with your overall financial strategy. Whether it’s for emergency expenses, debt consolidation, or business investments, having a clear purpose and plan for repayment ensures that borrowing contributes positively to your financial health.

By understanding how to borrow money from Cashapp responsibly, you can leverage it as a financial tool while maintaining and improving your overall financial well-being.

Case Studies

Real-life case studies can provide valuable insights into how to borrow money from Cashapp effectively. These examples highlight different scenarios and how users have successfully navigated the borrowing process.

Case Study 1: Emergency Medical Expense Jane, a Cash App user, faced an unexpected medical bill. She needed quick funds to cover the expense. Knowing how to borrow money from Cashapp, she applied for a loan through the app. The process was straightforward, and she received the funds within minutes. Jane managed her repayment schedule effectively, ensuring timely payments and avoiding additional fees. This case study illustrates the convenience and speed of Cash App loans in emergencies.

Case Study 2: Debt Consolidation John had several high-interest credit card debts. He learned how to borrow money from Cashapp and used the loan to consolidate his debts into a single payment. By doing this, he was able to reduce his overall interest payments and simplify his repayment process. John set up automatic payments to ensure he stayed on track. This case study demonstrates how Cash App loans can be used strategically for debt consolidation.

Case Study 3: Small Business Investment Sara wanted to invest in new equipment for her small business. She explored how to borrow money from Cashapp and decided to take a loan. The quick approval process allowed her to purchase the equipment immediately, boosting her business productivity. She carefully planned her repayments based on her business revenue, ensuring she met her obligations without financial strain. This case study shows the potential of Cash App loans for small business growth.

These case studies highlight the versatility and effectiveness of borrowing from Cash App in various scenarios, providing practical examples of successful borrowing experiences.

Expert Opinions

Expert opinions can provide valuable insights into how to borrow money from Cashapp and its place in the broader financial landscape. Financial experts often analyze the benefits and drawbacks of different borrowing methods, including Cash App loans.

According to financial advisor Mark Johnson, “Cash App loans offer a convenient solution for short-term financial needs. However, users should be aware of the interest rates and fees associated with these loans. Understanding how to borrow money from Cashapp and managing repayments effectively is crucial to avoid financial pitfalls.”

Financial analyst Susan Lee adds, “The simplicity and speed of Cash App loans are appealing, especially for those with limited access to traditional banking services. Knowing how to borrow money from Cashapp and using it wisely can help users bridge financial gaps without resorting to higher-cost alternatives like payday loans.”

Economist Dr. Alan Carter notes, “While Cash App provides a valuable service, it’s important for users to compare their options. Exploring how to borrow money from Cashapp alongside traditional loans, credit unions, and online lenders can help users find the best terms and rates for their needs.”

These expert opinions underscore the importance of understanding the costs and benefits of Cash App loans. By considering these insights, users can make informed decisions about how to borrow money from Cashapp and manage their financial needs effectively.

Technical Requirements and Compatibility

Understanding the technical requirements and compatibility is crucial when learning how to borrow money from Cashapp. Ensuring that your device and app are properly set up can prevent technical issues and streamline the borrowing process.

Cash App is compatible with both iOS and Android devices. To start, download the Cash App from the App Store or Google Play Store. Ensure that your device meets the minimum operating system requirements, which are typically specified in the app store listing. Keeping your device updated with the latest OS version can also help maintain compatibility and security.

Internet connectivity is essential for using Cash App effectively. A stable Wi-Fi or mobile data connection ensures smooth transactions and access to all app features, including borrowing. Understanding how to borrow money from Cashapp means ensuring you have reliable internet access.

The Cash App interface is designed to be user-friendly, but navigating it effectively requires a basic understanding of its features. Familiarize yourself with the different tabs and options, such as the ‘Banking’ tab where you can find the borrowing feature. Knowing where to find these features is crucial for a smooth borrowing experience.

If you encounter technical issues, such as app crashes or errors, ensure you have the latest version of Cash App installed. Restarting your device or reinstalling the app can often resolve these issues. For persistent problems, contacting Cash App support can provide additional assistance.

By ensuring your device and app are properly set up and compatible, you can navigate the process of how to borrow money from Cashapp with ease and confidence.

Updates and New Features

Staying informed about updates and new features is essential for anyone learning how to borrow money from Cashapp. Cash App frequently updates its services to enhance user experience and provide additional functionality.

Recent updates to Cash App have included improvements to the borrowing feature, making it more accessible and user-friendly. These updates often come with enhancements to the application process, repayment options, and security measures. Keeping the app updated ensures you have access to the latest features and improvements.

One notable update is the introduction of flexible borrowing limits. Cash App now adjusts borrowing limits based on user behavior and transaction history, providing more personalized loan options. Understanding these updates is crucial for maximizing the benefits of how to borrow money from Cashapp.

Cash App also periodically introduces new features that can enhance your borrowing experience. For instance, improved customer support options, such as live chat and enhanced FAQs, provide users with better assistance during the borrowing process. Staying informed about these features can make the borrowing process smoother and more efficient.

To stay updated, regularly check the Cash App’s blog or news section within the app. Following Cash App on social media platforms can also provide timely updates about new features and improvements. By staying informed, you can leverage the latest advancements to optimize your experience with borrowing money from Cash App.

Financial Literacy and Borrowing

Financial literacy plays a crucial role in understanding how to borrow money from Cashapp effectively. Being financially literate means having the knowledge and skills to make informed decisions about borrowing and managing money.

One aspect of financial literacy is understanding interest rates and how they affect the total cost of borrowing. When you borrow money from Cash App, knowing the interest rate and calculating the total repayment amount can help you plan your finances better. Understanding the difference between simple and compound interest is also beneficial.

Another key concept is budgeting. Creating a budget that includes your loan repayments ensures that you can meet your obligations without compromising other financial goals. By integrating loan repayments into your monthly budget, you can manage your cash flow more effectively.

It’s also important to understand credit and its impact on your financial health. While Cash App doesn’t perform hard credit checks, responsible borrowing and timely repayments can positively influence your creditworthiness. Learning how to borrow money from Cashapp and managing it responsibly can contribute to building a good credit history.

Financial literacy resources, such as online courses, books, and financial advisors, can provide valuable information. Cash App itself offers educational resources that can help users understand various financial concepts. By improving your financial literacy, you can make more informed decisions about borrowing money from Cash App and managing your overall financial health.

Using Borrowed Funds Wisely

Using borrowed funds wisely is crucial when you learn how to borrow money from Cashapp. Proper management of borrowed money can help you achieve your financial goals without falling into debt traps.

First, clearly define the purpose of the loan. Whether it’s for emergency expenses, debt consolidation, or business investment, having a specific goal ensures that the funds are used effectively. Planning how to borrow money from Cashapp with a clear objective helps you stay focused and disciplined in managing the loan.

Next, create a spending plan. Outline how the borrowed money will be allocated and stick to this plan. Avoid using the loan for non-essential expenses, as this can lead to unnecessary debt. Prioritizing essential expenditures ensures that the loan serves its intended purpose.

It’s also important to monitor your spending closely. Keep track of every transaction made with the borrowed funds. This helps you stay within your budget and avoid overspending. Using financial management tools or apps can assist in tracking your expenses and managing the loan effectively.

Consider using part of the loan to build an emergency fund. Having a financial cushion can help you handle unexpected expenses without needing to borrow again. This is a strategic way to use borrowed money from Cash App to improve your overall financial stability.

By using borrowed funds wisely, you can maximize the benefits of how to borrow money from Cashapp and ensure that the loan contributes positively to your financial well-being.

Tax Implications

Understanding the tax implications is essential when you learn how to borrow money from Cashapp. Knowing how loans affect your taxes can help you plan your finances more effectively.

Generally, the money you borrow from Cash App is not considered taxable income. This means you don’t need to report the loan amount as income on your tax return. However, it’s important to keep accurate records of the loan and its terms for your financial documentation.

Interest paid on personal loans from Cash App is usually not tax-deductible. Unlike mortgage interest or student loan interest, which may be deductible, personal loan interest doesn’t offer the same tax benefits. Knowing this helps you understand the full cost of borrowing and plan your repayments accordingly.

If you use the borrowed funds for business purposes, the interest paid on the loan may be deductible as a business expense. Keeping detailed records of how the loan is used for your business and consulting with a tax professional can help you take advantage of potential tax deductions.

In some cases, forgiven or cancelled loan amounts may be considered taxable income. While this is less common with personal loans, it’s important to be aware of the potential tax implications if your loan terms include forgiveness or cancellation clauses.

By understanding these tax implications, you can better manage your loan from Cash App and ensure compliance with tax laws. Knowing how to borrow money from Cashapp while being aware of the tax aspects can help you make more informed financial decisions.

Borrowing for Business Purposes

Learning how to borrow money from Cashapp for business purposes can provide valuable financial support for your small business. Using Cash App loans strategically can help you manage cash flow, invest in equipment, or cover unexpected expenses.

First, evaluate your business needs and determine how much funding you require. Having a clear understanding of your financial needs ensures that you borrow an appropriate amount. Planning how to borrow money from Cashapp with a specific business goal in mind helps you use the funds effectively.

Next, outline a repayment plan based on your business revenue. Ensure that the loan repayments align with your cash flow to avoid financial strain. Setting up automatic repayments through Cash App can help you stay on track and manage the loan efficiently.

Using the borrowed funds to invest in revenue-generating activities can enhance your business growth. This might include purchasing new equipment, expanding your product line, or funding marketing campaigns. Strategic use of borrowed money can provide a significant return on investment, contributing to your business’s success.

It’s also important to maintain detailed records of how the loan is used for business purposes. This not only helps in managing the loan but also provides documentation for tax purposes. Consulting with a financial advisor can provide additional insights into how to borrow money from Cashapp effectively for your business.

By understanding the specific needs of your business and planning the use of borrowed funds strategically, you can leverage Cash App loans to support and grow your small business.

Emergency Borrowing

Knowing how to borrow money from Cashapp for emergency purposes can provide crucial financial relief during unexpected situations. Cash App’s quick and straightforward borrowing process makes it an ideal option for emergencies.

In an emergency, time is of the essence. Cash App allows you to borrow money quickly, often providing funds within minutes. This speed can be critical when dealing with urgent expenses such as medical bills, car repairs, or unexpected travel. Understanding how to borrow money from Cashapp efficiently can help you address these emergencies promptly.

When borrowing for emergencies, it’s essential to assess the urgency and necessity of the expense. Borrowing should be reserved for truly urgent situations to avoid unnecessary debt. Having a clear understanding of your financial situation and the specific need for the loan ensures that the borrowed funds are used appropriately.

Once you receive the funds, prioritize the emergency expense and allocate the money accordingly. Avoid using the loan for non-essential items, as this can lead to financial strain. Keeping focused on the immediate need helps you manage the loan effectively.

After the emergency is resolved, create a repayment plan to pay off the loan as quickly as possible. Setting up automatic payments can help ensure timely repayments, reducing the risk of additional fees or interest. Managing the repayment efficiently is crucial to maintaining financial stability after an emergency.

By knowing how to borrow money from Cashapp for emergencies and managing the loan responsibly, you can navigate financial crises with confidence and minimal stress.

Building a Strong Credit History with Cash App

Understanding how to borrow money from Cashapp can also contribute to building a strong credit history. Although Cash App does not report to credit bureaus, responsible borrowing and repayment practices can still positively impact your overall financial health.

First, treat your Cash App loan as you would any traditional loan. Make timely repayments and avoid missing any due dates. This practice demonstrates financial responsibility, which can be beneficial if you seek other types of credit in the future. Learning how to borrow money from Cashapp and managing it well sets a positive precedent for your financial behavior.

Keeping a positive balance in your Cash App account and using the app regularly for transactions can also reflect well on your financial habits. While these actions don’t directly impact your credit score, they build a pattern of responsible financial management.

Additionally, if you plan to apply for credit from other sources, such as credit cards or bank loans, having a good track record with Cash App loans can be a supportive reference. Lenders often consider your overall financial behavior when assessing credit applications.

By using borrowed funds wisely and maintaining a disciplined repayment schedule, you demonstrate the ability to manage credit effectively. This can indirectly support your creditworthiness and improve your chances of obtaining other types of credit in the future.

Understanding how to borrow money from Cashapp and leveraging it to build a strong financial history can provide long-term benefits, enhancing your financial opportunities and stability.

International Borrowing Considerations

When exploring how to borrow money from Cashapp as an international user, there are several important considerations. While Cash App primarily operates in the United States and the United Kingdom, understanding the specifics of international borrowing can help you navigate the process.

First, verify if the borrowing feature is available in your region. Cash App’s borrowing options may not be accessible to all international users. Check the app’s terms and conditions or contact customer support to confirm availability.

Next, consider the currency exchange rates and potential fees associated with international transactions. If you borrow money in a currency different from your local one, fluctuations in exchange rates can affect the amount you repay. Understanding these financial implications is crucial when learning how to borrow money from Cashapp internationally.

Additionally, be aware of any legal and regulatory requirements in your country. Financial regulations can vary significantly, and it’s important to ensure that borrowing from Cash App complies with local laws. Consulting with a financial advisor familiar with international borrowing can provide valuable guidance.

If you travel frequently or have financial commitments in multiple countries, managing the borrowed funds and repayments can become more complex. Setting up automatic repayments and monitoring currency exchange rates can help you manage these challenges effectively.

By understanding the specific considerations for international borrowing, you can navigate how to borrow money from Cashapp more confidently and manage your finances across borders.

Ethical Borrowing

Practicing ethical borrowing is essential when learning how to borrow money from Cashapp. Ethical borrowing involves using borrowed funds responsibly and ensuring that your financial actions do not negatively impact others.

First, only borrow what you need and can afford to repay. Ethical borrowing means assessing your financial situation realistically and avoiding unnecessary debt. When you understand how to borrow money from Cashapp responsibly, you make informed decisions that align with your financial capabilities.

Next, prioritize transparency and honesty in your borrowing practices. Ensure that all information you provide during the loan application is accurate and truthful. Misrepresenting your financial situation can lead to complications and undermine ethical borrowing principles.

Consider the impact of your borrowing on others. For instance, borrowing from Cash App for non-essential items while neglecting critical financial responsibilities can have negative repercussions. Ethical borrowing involves making decisions that consider the broader impact on your financial health and obligations.

If you face difficulties in repaying the loan, communicate proactively with Cash App support. Seeking assistance or negotiating a revised repayment plan demonstrates responsible and ethical behavior. Avoiding defaults or late payments helps maintain a positive borrowing relationship and supports your long-term financial well-being.

By practicing ethical borrowing, you can navigate how to borrow money from Cashapp with integrity, ensuring that your financial actions are responsible and sustainable.

Peer-to-Peer Lending on Cash App

Exploring peer-to-peer lending is another aspect of how to borrow money from Cashapp. While Cash App itself does not currently offer peer-to-peer lending, understanding this concept can provide additional borrowing options.

Peer-to-peer (P2P) lending involves borrowing money directly from individual lenders through an online platform. This method can offer competitive interest rates and more flexible terms compared to traditional lending. Learning how to borrow money from Cashapp and considering P2P lending can diversify your borrowing options.

Several P2P lending platforms, such as LendingClub and Prosper, connect borrowers with individual lenders. These platforms typically require a credit check and provide loans based on your creditworthiness and financial history. Understanding how these platforms work can help you assess if P2P lending is a viable alternative to borrowing from Cash App.

P2P lending offers benefits such as potentially lower interest rates and faster approval processes. However, it’s important to read the terms and conditions carefully and understand the risks involved. Defaulting on a P2P loan can have serious consequences, including legal action from individual lenders.

By exploring peer-to-peer lending alongside learning how to borrow money from Cashapp, you can find the best borrowing solution for your financial needs. Diversifying your borrowing options ensures you have access to the most favorable terms and conditions available.

Cash App’s Borrowing Policies

Understanding Cash App’s borrowing policies is crucial when learning how to borrow money from Cashapp. These policies outline the terms and conditions of borrowing and ensure that users are informed about their rights and responsibilities.

Cash App’s borrowing policies typically include information on eligibility criteria, interest rates, fees, and repayment terms. It’s important to read these policies thoroughly before applying for a loan. Knowing the specifics of how to borrow money from Cashapp ensures that you are aware of all the terms and conditions associated with the loan.

Eligibility criteria are a key component of Cash App’s borrowing policies. These criteria determine who can access the borrowing feature and may include factors such as account verification, transaction history, and financial behavior. Understanding these criteria helps you assess your eligibility and prepare for the borrowing process.

Interest rates and fees are also detailed in the borrowing policies. Cash App provides clear information on the costs associated with borrowing, including any processing fees, late payment fees, and early repayment penalties. Knowing these costs helps you plan your finances and manage the loan effectively.

Repayment terms outline the schedule and methods for repaying the loan. Cash App typically offers flexible repayment options, including automatic deductions from your linked bank account or Cash App balance. Understanding these terms ensures that you can meet your repayment obligations without financial strain.

By familiarizing yourself with Cash App’s borrowing policies, you can navigate how to borrow money from Cashapp with confidence and ensure that you are fully informed about all aspects of the loan.

Advanced Borrowing Strategies

Advanced borrowing strategies can enhance your understanding of how to borrow money from Cashapp and maximize the benefits of using borrowed funds. These strategies involve leveraging loans for strategic financial goals and managing repayments effectively.

One advanced strategy is using borrowed funds for investment purposes. For instance, if you have a high-confidence investment opportunity with a potential return greater than the loan’s interest rate, borrowing money can be a strategic move. Understanding how to borrow money from Cashapp and using the funds for profitable investments can generate additional income.

Debt consolidation is another advanced strategy. If you have multiple high-interest debts, using a Cash App loan to consolidate them into a single, lower-interest payment can simplify your finances and reduce overall interest costs. This strategy requires careful planning and an understanding of how to borrow money from Cashapp to achieve the best results.

Another strategy involves timing your borrowing to take advantage of favorable financial conditions. For example, borrowing money when interest rates are low can reduce the cost of the loan. Monitoring market trends and economic indicators can help you determine the optimal time to borrow.

It’s also beneficial to set up a financial buffer when borrowing. This involves saving a portion of the loan amount as an emergency fund to cover unexpected expenses. This strategy ensures that you can manage the loan without compromising your financial stability.

By applying these advanced borrowing strategies, you can optimize your use of borrowed funds and achieve your financial goals more effectively.

Ethical Borrowing

Practicing ethical borrowing is essential when learning how to borrow money from Cashapp. Ethical borrowing involves using borrowed funds responsibly and ensuring that your financial actions do not negatively impact others.

First, only borrow what you need and can afford to repay. Ethical borrowing means assessing your financial situation realistically and avoiding unnecessary debt. When you understand how to borrow money from Cashapp responsibly, you make informed decisions that align with your financial capabilities.

Next, prioritize transparency and honesty in your borrowing practices. Ensure that all information you provide during the loan application is accurate and truthful. Misrepresenting your financial situation can lead to complications and undermine ethical borrowing principles.

Consider the impact of your borrowing on others. For instance, borrowing from Cash App for non-essential items while neglecting critical financial responsibilities can have negative repercussions. Ethical borrowing involves making decisions that consider the broader impact on your financial health and obligations.

If you face difficulties in repaying the loan, communicate proactively with Cash App support. Seeking assistance or negotiating a revised repayment plan demonstrates responsible and ethical behavior. Avoiding defaults or late payments helps maintain a positive borrowing relationship and supports your long-term financial well-being.

By practicing ethical borrowing, you can navigate how to borrow money from Cashapp with integrity, ensuring that your financial actions are responsible and sustainable.

Conclusion and Future Outlook

Understanding how to borrow money from Cashapp provides valuable financial flexibility and convenience. By following the outlined steps and best practices, you can effectively navigate the borrowing process and manage your finances responsibly.

As Cash App continues to evolve, new features and improvements are likely to enhance the borrowing experience. Staying informed about these updates ensures that you can take full advantage of the platform’s capabilities. Regularly checking for updates and exploring new borrowing options can help you stay ahead of financial trends.

The future of app-based borrowing looks promising, with more personalized and user-friendly features expected to emerge. As financial technology advances, borrowing money through platforms like Cash App will likely become even more accessible and efficient.

By understanding how to borrow money from Cashapp and staying informed about future developments, you can leverage this financial tool to achieve your goals and maintain financial stability. Whether you need funds for emergencies, investments, or business growth, Cash App offers a flexible and convenient solution for your borrowing needs.

Frequently Asked Questions

Addressing frequently asked questions about how to borrow money from Cashapp can provide clarity and help users navigate the process with confidence.

Who is eligible to borrow money from Cash App?

Eligibility depends on several factors, including your account status, transaction history, and creditworthiness. Not all users will have the borrowing feature available.

How do I apply for a loan on Cash App?

Navigate to the ‘Banking’ tab in Cash App and select the ‘Borrow’ option. Follow the prompts to enter the amount you wish to borrow and review the loan terms before accepting.

What are the interest rates and fees for Cash App loans?

Interest rates and fees vary based on several factors, including the loan amount and repayment terms. It’s important to review these details carefully during the application process.

How is the repayment schedule structured?

Cash App typically offers flexible repayment schedules with automatic deductions from your linked bank account or Cash App balance. The specific terms will be outlined in your loan agreement.

Can I repay my loan early?

Yes, early repayment is usually allowed. Check your loan terms for any early repayment fees or conditions.

How does borrowing from Cash App affect my credit score?

Cash App does not perform a hard credit check, so your credit score is not directly impacted. However, responsible borrowing and timely repayments can positively influence your overall financial health.

By addressing these common questions, users can better understand how to borrow money from Cashapp and navigate the process with greater ease and confidence.

What Is Cash App Borrow?

Cash App Borrow is a feature allowing users to take short-term loans directly through the Cash App.

Who Can Use Cash App Borrow?

Only eligible users with a positive account history and consistent deposits can access Cash App Borrow.

How Much Can I Borrow On Cash App?

You can borrow between $20 to $200, depending on your eligibility and account history.

How Do I Qualify For Cash App Borrow?

Maintain a positive account balance, regular deposits, and frequent app usage to qualify for Cash App Borrow.

How Do I Request A Loan On Cash App?

Go to the “Banking” tab, select “Borrow,” choose the amount, and follow the instructions to request a loan.

What Is The Interest Rate For Cash App Borrow?

Interest rates for Cash App Borrow vary but are generally around 5% for short-term loans.

How Long Do I Have To Repay Cash App Borrow?

You typically have four weeks to repay the borrowed amount plus interest.

Can I Extend My Cash App Borrow Repayment?

No, Cash App does not currently offer repayment extensions for borrowed amounts.

What Happens If I Don’t Repay On Time?

Late repayments can result in additional fees and may affect your eligibility for future loans.

Is Cash App Borrow Safe To Use?

Yes, Cash App Borrow is secure, as Cash App uses encryption and security measures to protect user information.